All Categories

Featured

Table of Contents

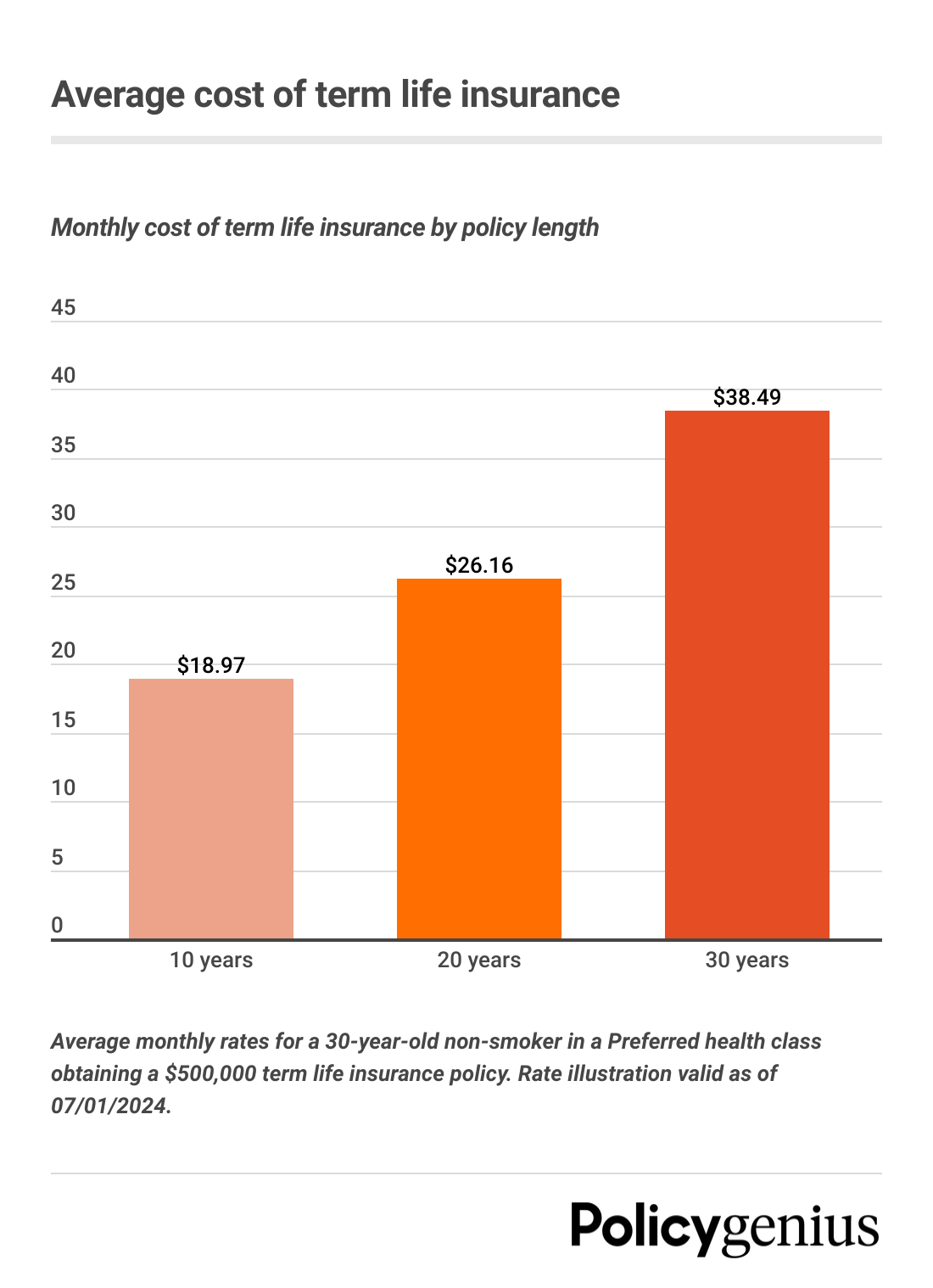

Term plans are likewise usually level-premium, but the overage quantity will remain the same and not expand. One of the most usual terms are 10, 15, 20, and three decades, based on the needs of the insurance holder. Level-premium insurance policy is a sort of life insurance in which costs stay the same rate throughout the term, while the quantity of insurance coverage used increases.

For a term plan, this means for the length of the term (e.g. 20 or 30 years); and for a long-term plan, until the insured passes away. Over the long run, level-premium payments are often much more economical.

They each look for a 30-year term with $1 million in protection. Jen purchases an assured level-premium plan at around $42 per month, with a 30-year horizon, for a total amount of $500 each year. Beth numbers she might just need a plan for three-to-five years or up until full payment of her existing financial debts.

So in year 1, she pays $240 annually, 1 and about $500 by year 5. In years 2 with 5, Jen proceeds to pay $500 each month, and Beth has paid approximately just $357 annually for the exact same $1 numerous protection. If Beth no much longer needs life insurance coverage at year five, she will certainly have saved a great deal of cash about what Jen paid.

What is Guaranteed Level Term Life Insurance Coverage Like?

Yearly as Beth ages, she faces ever-higher yearly premiums. Jen will certainly proceed to pay $500 per year. Life insurance companies are able to give level-premium policies by essentially "over-charging" for the earlier years of the policy, gathering greater than what is needed actuarially to cover the risk of the insured dying during that early period.

Long-term life insurance policy develops money worth that can be borrowed. Plan finances build up passion and unsettled policy car loans and interest will certainly reduce the fatality advantage and cash worth of the policy. The quantity of cash value offered will generally depend upon the kind of long-term plan purchased, the amount of coverage bought, the length of time the policy has actually been in force and any kind of impressive policy finances.

A full statement of insurance coverage is found just in the policy. Insurance coverage policies and/or associated bikers and features may not be available in all states, and plan terms and problems may differ by state.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. whole life insurance with investment benefits agents specialize in. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

Level term life insurance coverage is the most uncomplicated way to get life cover. In this post, we'll describe what it is, how it functions and why level term may be right for you.

How Does Level Benefit Term Life Insurance Compare to Other Types?

Term life insurance is a kind of plan that lasts a details length of time, called the term. You choose the length of the policy term when you first take out your life insurance policy.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Pick your term and your quantity of cover. Select the plan that's right for you., you know your premiums will certainly stay the very same throughout the term of the policy.

(Nevertheless, you don't obtain any type of cash back) 97% of term life insurance cases are paid by the insurer - SourceLife insurance policy covers most circumstances of fatality, but there will be some exclusions in the regards to the plan. Exemptions might consist of: Genetic or pre-existing conditions that you failed to reveal at the begin of the policyAlcohol or medicine abuseDeath while dedicating a crimeAccidents while participating in dangerous sportsSuicide (some plans omit death by self-destruction for the first year of the policy) You can add vital disease cover to your level term life insurance for an extra price.Important ailment cover pays a part of your cover quantity if you are diagnosed with a serious disease such as cancer cells, cardiovascular disease or stroke.

After this, the plan finishes and the surviving partner is no longer covered. Joint policies are normally a lot more budget friendly than solitary life insurance policies.

What Is Annual Renewable Term Life Insurance? The Complete Overview?

This safeguards the buying power of your cover quantity versus inflationLife cover is a wonderful thing to have since it supplies monetary defense for your dependents if the worst occurs and you pass away. Your liked ones can likewise utilize your life insurance coverage payment to pay for your funeral. Whatever they choose to do, it's great peace of mind for you.

Nevertheless, level term cover is fantastic for fulfilling daily living costs such as family costs. You can also utilize your life insurance policy advantage to cover your interest-only home mortgage, settlement mortgage, college costs or any type of various other debts or continuous payments. On the various other hand, there are some downsides to level cover, compared to various other sorts of life policy.

Term life insurance coverage is a budget friendly and simple option for many individuals. You pay costs every month and the insurance coverage lasts for the term size, which can be 10, 15, 20, 25 or three decades. What is a level term life insurance policy. Yet what happens to your costs as you age depends on the kind of term life insurance policy protection you buy.

What is Short Term Life Insurance? A Simple Explanation?

As long as you continue to pay your insurance premiums monthly, you'll pay the exact same price throughout the whole term length which, for numerous term plans, is commonly 10, 15, 20, 25 or 30 years. When the term ends, you can either pick to end your life insurance policy protection or restore your life insurance policy policy, usually at a higher rate.

A 35-year-old female in exceptional wellness can get a 30-year, $500,000 Haven Term plan, released by MassMutual starting at $29.15 per month. Over the following 30 years, while the plan remains in area, the price of the protection will certainly not alter over the term duration - Level term life insurance. Let's face it, the majority of us do not like for our expenses to expand gradually

Your degree term price is determined by a number of factors, a lot of which are associated with your age and wellness. Various other variables include your specific term plan, insurance provider, benefit amount or payment. During the life insurance coverage application procedure, you'll address inquiries about your health and wellness background, consisting of any kind of pre-existing conditions like an essential illness.

Latest Posts

Funeral Expense Insurance Policy

Compare Funeral Insurance

Is Funeral Insurance Worth It