All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. mortgage protection insurance through an agent. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

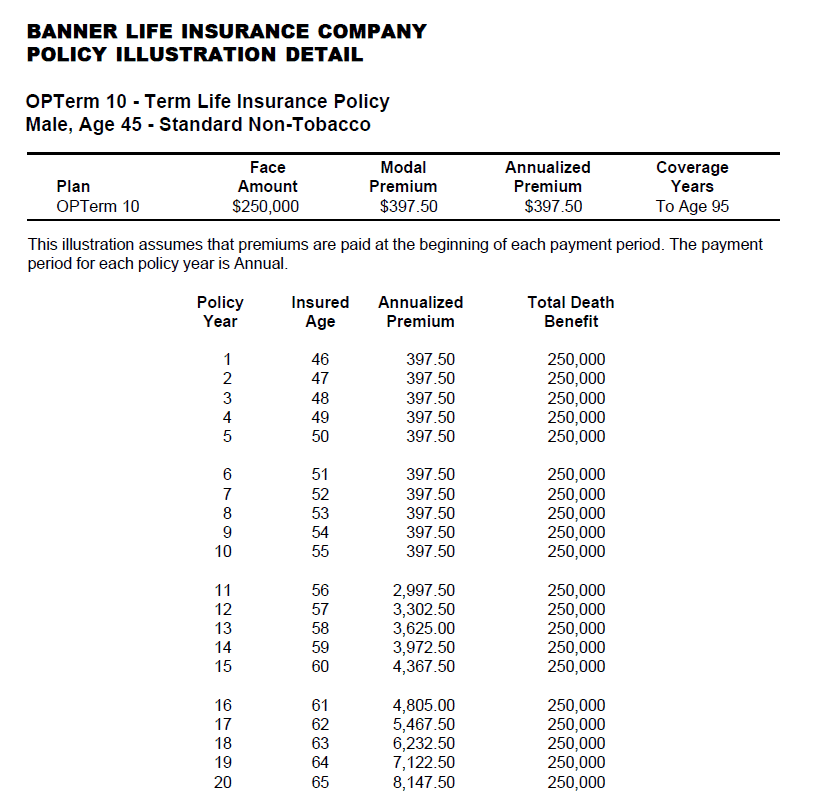

If you select level term life insurance, you can allocate your premiums since they'll remain the exact same throughout your term. And also, you'll know exactly just how much of a death advantage your beneficiaries will certainly receive if you pass away, as this amount will not change either. The prices for degree term life insurance policy will depend upon a number of aspects, like your age, health and wellness standing, and the insurance firm you pick.

Once you go via the application and medical examination, the life insurance firm will certainly assess your application. Upon approval, you can pay your initial costs and authorize any appropriate documents to ensure you're covered.

Aflac's term life insurance is practical. You can choose a 10, 20, or thirty years term and take pleasure in the included satisfaction you are worthy of. Dealing with a representative can aid you find a policy that works best for your requirements. Discover more and get a quote today!.

As you try to find means to safeguard your financial future, you have actually most likely come throughout a wide array of life insurance policy options. what is level term life insurance. Choosing the best protection is a huge choice. You intend to find something that will help support your loved ones or the causes important to you if something occurs to you

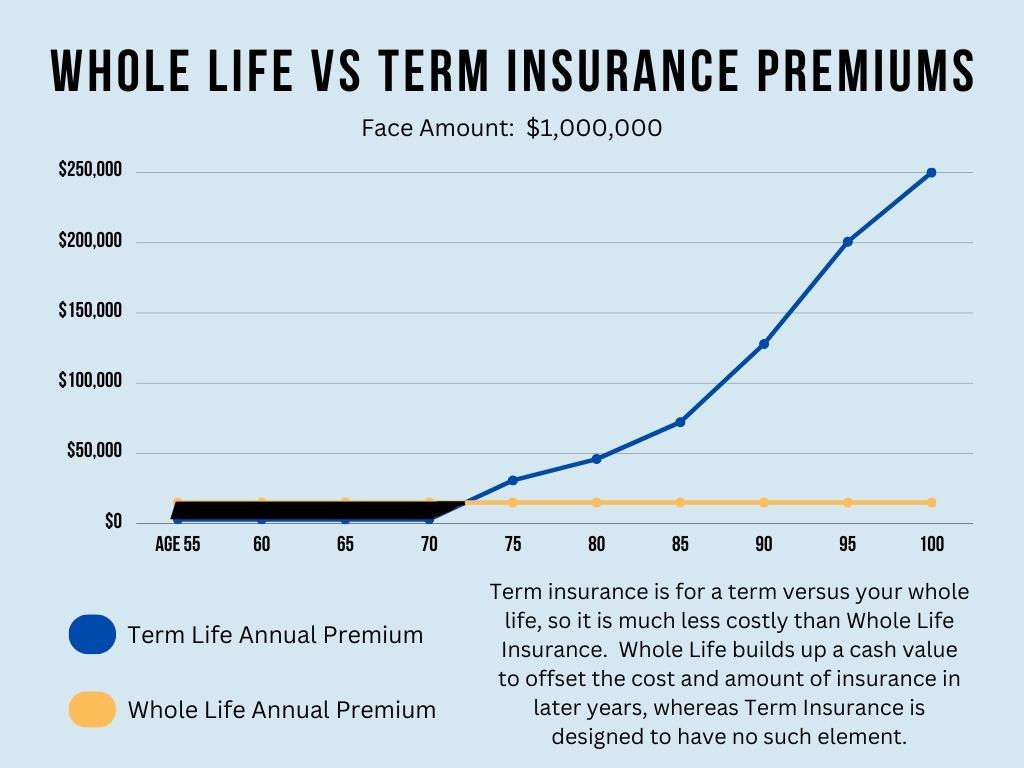

Many individuals favor term life insurance policy for its simplicity and cost-effectiveness. Term insurance contracts are for a relatively short, specified duration of time but have options you can tailor to your demands. Particular advantage alternatives can make your premiums change in time. Level term insurance policy, nonetheless, is a type of term life insurance policy that has consistent settlements and an imperishable.

Coverage-Focused Annual Renewable Term Life Insurance

Level term life insurance is a subset of It's called "degree" because your costs and the benefit to be paid to your enjoyed ones remain the same throughout the contract. You won't see any kind of adjustments in expense or be left asking yourself concerning its value. Some contracts, such as each year eco-friendly term, may be structured with costs that increase gradually as the insured ages.

They're identified at the begin and continue to be the same. Having consistent payments can assist you far better plan and spending plan because they'll never transform. Taken care of death benefit. This is likewise set at the start, so you can recognize exactly what survivor benefit amount your can expect when you die, as long as you're covered and current on costs.

You agree to a fixed premium and fatality benefit for the duration of the term. If you pass away while covered, your death benefit will certainly be paid out to liked ones (as long as your premiums are up to date).

You may have the choice to for another term or, more probable, restore it year to year. If your agreement has actually an assured renewability provision, you may not require to have a new clinical exam to keep your protection going. Your costs are likely to boost since they'll be based on your age at revival time.

With this alternative, you can that will last the rest of your life. In this case, once more, you might not require to have any kind of new medical examinations, however costs likely will increase as a result of your age and brand-new coverage. level premium term life insurance policies. Various firms offer various alternatives for conversion, make sure to comprehend your selections prior to taking this action

Dependable Level Term Life Insurance

A lot of term life insurance policy is level term for the duration of the agreement period, yet not all. With reducing term life insurance coverage, your death benefit goes down over time (this kind is typically taken out to specifically cover a long-term debt you're paying off).

And if you're set up for renewable term life, after that your costs likely will go up each year. If you're checking out term life insurance policy and intend to make sure simple and predictable financial defense for your family, level term may be something to consider. As with any kind of type of protection, it may have some limitations that don't meet your demands.

Comprehensive Level Premium Term Life Insurance Policies

Commonly, term life insurance is more economical than irreversible coverage, so it's a cost-efficient way to protect monetary security. Adaptability. At the end of your agreement's term, you have several choices to continue or move on from insurance coverage, frequently without requiring a clinical examination. If your budget or insurance coverage needs modification, death advantages can be decreased in time and cause a reduced costs.

As with other kinds of term life insurance coverage, as soon as the agreement finishes, you'll likely pay greater costs for insurance coverage due to the fact that it will certainly recalculate at your current age and health and wellness. If your monetary situation changes, you may not have the essential protection and might have to buy extra insurance.

That does not suggest it's a fit for every person. As you're shopping for life insurance policy, below are a couple of key elements to consider: Spending plan. One of the advantages of level term insurance coverage is you understand the price and the fatality advantage upfront, making it much easier to without bothering with increases with time.

Usually, with life insurance, the much healthier and younger you are, the a lot more inexpensive the insurance coverage. If you're young and healthy and balanced, it might be an appealing alternative to lock in low premiums now. If you have a young family, for circumstances, degree term can help supply monetary support throughout critical years without paying for protection much longer than required.

1 All motorcyclists undergo the terms and problems of the biker. All cyclists may not be readily available in all territories. Some states may differ the terms and conditions (joint term life insurance). There might be a surcharge related to obtaining particular bikers. Some bikers might not be offered in combination with other riders and/or policy features.

2 A conversion credit history is not readily available for TermOne policies. 3 See Term Conversions area of the Term Series 160 Product Overview for how the term conversion credit scores is established. A conversion debt is not readily available if premiums or costs for the new policy will certainly be waived under the terms of a motorcyclist giving disability waiver benefits.

Dependable Decreasing Term Life Insurance

Term Collection products are released by Equitable Financial Life Insurance Firm (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Company of California, LLC in CA; Equitable Network Insurance Policy Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance coverage is a kind of life insurance coverage plan that covers the insurance policy holder for a details amount of time, which is understood as the term. Terms usually vary from 10 to 30 years and increase in 5-year increments, giving degree term insurance.

Latest Posts

Funeral Expense Insurance Policy

Compare Funeral Insurance

Is Funeral Insurance Worth It