All Categories

Featured

Table of Contents

Policies can also last up until specified ages, which in many situations are 65. Beyond this surface-level information, having a better understanding of what these strategies entail will certainly help ensure you purchase a plan that meets your requirements.

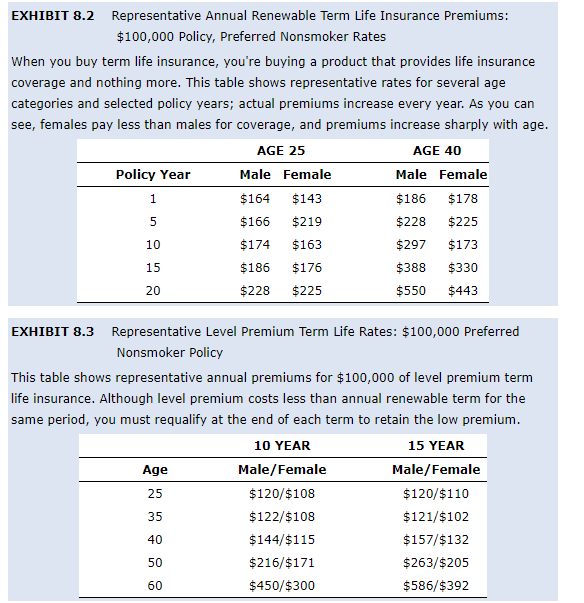

Be mindful that the term you select will affect the premiums you spend for the plan. A 10-year degree term life insurance policy plan will certainly set you back much less than a 30-year plan due to the fact that there's less chance of an occurrence while the strategy is active. Reduced danger for the insurer equates to reduce costs for the insurance policy holder.

Your family's age need to likewise affect your plan term option. If you have young children, a longer term makes good sense because it shields them for a longer time. If your youngsters are near their adult years and will certainly be economically independent in the close to future, a shorter term could be a far better fit for you than a lengthy one.

When comparing entire life insurance policy vs. term life insurance, it deserves noting that the latter normally sets you back less than the former. The result is a lot more coverage with lower costs, offering the most effective of both globes if you require a considerable amount of coverage but can't pay for a much more expensive plan.

Why You Need to Understand Level Premium Term Life Insurance

A level fatality benefit for a term policy usually pays out as a swelling sum. Some level term life insurance firms allow fixed-period payments.

Passion payments obtained from life insurance policy policies are considered income and undergo tax. When your level term life plan ends, a few different points can happen. Some insurance coverage ends right away with no choice for renewal. In various other situations, you can pay to expand the strategy past its initial date or transform it right into a long-term policy.

The disadvantage is that your eco-friendly degree term life insurance coverage will come with greater costs after its initial expiry. Ads by Cash.

Life insurance policy business have a formula for computing threat using death and rate of interest (What does level term life insurance mean). Insurance providers have countless clients securing term life policies at the same time and use the costs from its active plans to pay enduring beneficiaries of various other policies. These firms use mortality tables to estimate exactly how several individuals within a particular group will file death claims each year, and that information is used to identify typical life span for possible policyholders

In addition, insurance policy business can invest the cash they obtain from premiums and increase their income. Since a degree term plan does not have cash money value, as an insurance policy holder, you can not spend these funds and they don't offer retirement earnings for you as they can with entire life insurance coverage plans. The insurance firm can spend the cash and earn returns.

The following section information the advantages and disadvantages of level term life insurance coverage. Predictable premiums and life insurance protection Streamlined plan structure Potential for conversion to permanent life insurance coverage Restricted protection duration No money value build-up Life insurance policy costs can enhance after the term You'll locate clear advantages when comparing degree term life insurance policy to various other insurance coverage types.

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. final expense plans with immediate coverage brokers recommend. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

What is Voluntary Term Life Insurance Coverage?

You always know what to anticipate with low-cost level term life insurance protection. From the moment you secure a policy, your premiums will certainly never ever alter, assisting you prepare monetarily. Your protection will not vary either, making these policies efficient for estate preparation. If you value predictability of your repayments and the payouts your heirs will receive, this kind of insurance could be an excellent suitable for you.

If you go this course, your costs will certainly raise yet it's always good to have some adaptability if you want to maintain an active life insurance plan. Renewable degree term life insurance policy is an additional choice worth considering. These policies permit you to keep your current strategy after expiry, giving adaptability in the future.

What is What Is Level Term Life Insurance? An Overview for New Buyers?

Unlike a entire life insurance policy policy, degree term insurance coverage doesn't last forever. You'll choose a coverage term with the very best level term life insurance coverage prices, but you'll no much longer have coverage once the plan expires. This downside can leave you clambering to discover a new life insurance coverage plan in your later years, or paying a premium to prolong your current one.

Many whole, universal and variable life insurance coverage policies have a money value part. With among those plans, the insurance company transfers a section of your monthly costs payments right into a cash worth account. This account makes rate of interest or is spent, aiding it expand and supply a much more considerable payout for your beneficiaries.

With a level term life insurance policy policy, this is not the instance as there is no cash worth part. Consequently, your policy won't expand, and your survivor benefit will never boost, thereby restricting the payout your beneficiaries will certainly obtain. If you want a policy that offers a fatality advantage and develops cash worth, check into entire, global or variable strategies.

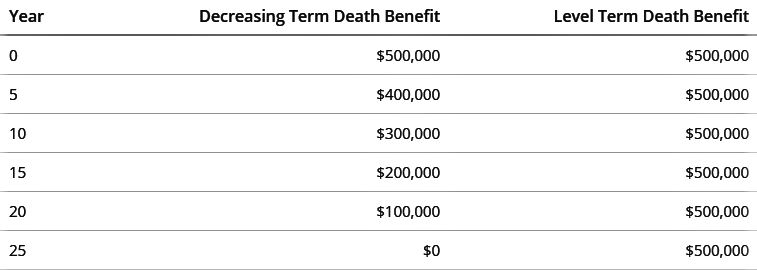

The 2nd your policy expires, you'll no much longer have life insurance policy coverage. Level term and lowering life insurance coverage deal comparable plans, with the main distinction being the death benefit.

It's a sort of cover you have for a certain amount of time, called term life insurance coverage. If you were to pass away while you're covered for (the term), your liked ones get a set payment concurred when you secure the plan. You just select the term and the cover amount which you might base, as an example, on the expense of raising kids until they leave home and you can use the repayment towards: Aiding to pay off your mortgage, debts, bank card or loans Assisting to spend for your funeral costs Aiding to pay university charges or wedding expenses for your kids Aiding to pay living prices, changing your income.

How Does 20-year Level Term Life Insurance Protect Your Loved Ones?

The policy has no money worth so if your repayments stop, so does your cover. The payment remains the same throughout the term. As an example, if you get a degree term life insurance plan you might: Choose a dealt with quantity of 250,000 over a 25-year term. If during this time you die, the payout of 250,000 will be made.

Latest Posts

Funeral Expense Insurance Policy

Compare Funeral Insurance

Is Funeral Insurance Worth It